Understanding Profit and Loss (P&L) Statements: A Complete Guide

Why Every Business Owner Must Understand P&L Statements

Business operations would become highly uncertain when owners cannot determine whether their operations produce profits instead of losses. Sounds risky, right? The P&L statement requires a deep understanding from business performers because it serves as a vital financial document. A P&L statement functions as a business financial evaluation system that reveals business success or failure. This article will provide straightforward explanations about analyzing your company’s financial health without worry.

What is a Profit and Loss Statement?

During a selected time period the P&L statement displays financial results that compare revenues with expenses. The document functions as an alternative name called Income Statement. Organizations use P&L statements to measure profitability in order to make strategic financial choices.

Why is a P&L Statement Important?

During a selected period the Profit and Loss (P&L) statement reveals the financial results that emerge from comparing revenues with expenses. The P&L document maintains an alternative naming convention as an income statement. An organization utilizes P&L statements to determine profitability levels and build financial strategies.

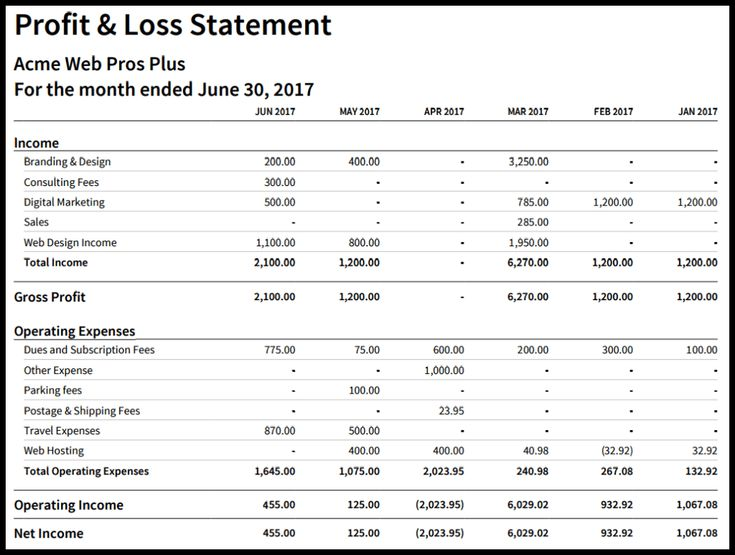

Components of a Profit and Loss Statement

A well-structured P&L statement includes several key components:

1. Revenue

The business income includes all revenue from sales or services prior to subtracting expenses.

2. Cost of Goods Sold (COGS)

The fundamental costs needed to make products and deliver services consist of labor expenses and materials.

3. Gross Profit

The formula to calculate gross profit stands at Revenue – Cost of Goods Sold which reveals the amount remaining after processing expenses.

4. Operating Expenses

These are the day-to-day expenses like rent, utilities, and salaries.

5. Net Profit

The final amount left after subtracting all expenses from total revenue: Net Profit = Gross Profit – Operating Expenses

How to Read a P&L Statement

Here’s a step-by-step guide:

1.Check the revenue level for incoming business funds.

2.Determine the fixed and variable components of spent funds.

3.Business profitability status can be determined by analyzing whether operations produce a positive net profit or show negative results.

4.Past reports enable a trend analysis that supports superior decision-making..

Latest Trends and Updates in P&L Analysis

AI-based systems control both P&L tracking and forecasting functions for numerous businesses.

Businesses operate with the help of accounting software through the cloud to handle their P&L needs efficiently.

Financial reports of modern companies integrate environmental expenses into their accounting operations for sustainability purposes.

Common Mistakes to Avoid in P&L Statements

- Ignoring small expenses: Even minor costs add up over time.

- Not updating records regularly: Monthly tracking ensures better decision-making.

- Mixing personal and business finances: This leads to inaccurate statements.

Conclusion: Why Every Business Needs a P&L Statement

Knowing your financial health requires the use of a Profit and Loss statement. Businesses that monitor their revenues along with expenses make wiser choices about finances while also winning investments and achieving long-term achievements.

Businesses that use contemporary accounting software for P&L tracking experience automated systems which minimize operational mistakes.!

FAQs

Q1: How often should I prepare a P&L statement? A: Ideally, every month or quarter for better financial tracking.

A P&L statement contrasts with a balance sheet since it reports financial gain and expense activity while the balance sheet shows asset and debt information. The P&L statement utilizes profit and expenditure data whereas the balance sheet includes asset and liability information.

Q3: Can a P&L statement help with tax filing? A: Yes, it provides necessary financial data to calculate taxable income accurately.